Global Overview of the Cosmetics Industry

The cosmetics industry remains one of the world’s highest-value markets, characterized by continuous growth and fierce competition. Factors such as consumer behavior, cultural influences, infrastructure readiness, and the dominance of social media all shape the industry’s trajectory. Among the most noteworthy markets are Thailand, South Korea, Japan, and the United States. Each country holds distinct strengths and faces unique challenges. By comparing trends and marketing strategies across these four markets, Thai beauty brand owners can craft more precise, informed business plans.

1) Thailand’s Cosmetics Market: The Power of Social Media Drives Immediate Sales

Key Strengths

- High Social Media Usage: Thailand is among the top countries where consumers spend significant time on platforms like Facebook, TikTok, LINE, and Instagram. As a result, influencer reviews and live streaming have a major impact on purchasing decisions.

- Fast-Growing Social Commerce: Live commerce—selling products via live streams—has gained huge popularity. From major e-commerce marketplaces like Shopee and Lazada to TikTok Shop, social commerce continues to expand rapidly.

- Quick Adaptation by Local Brands: A prime example is Mistine, which transitioned from traditional direct sales to an omnichannel approach, aggressively entering social commerce (e.g., TikTok Shop) and generating massive sales both domestically and abroad.

Key Challenges

- Relatively Small Market Size: Compared to the U.S. or China, Thailand’s overall spending power is lower, intensifying price competition.

- Lagging Innovation: Many Thai brands rely on trends from Korea or Japan, lacking unique product innovations of their own.

- Review Standards: Overpromising or misleading advertising poses serious reputational risks. If brands choose untrustworthy reviewers, it can damage credibility in the long run.

Strategic Tips for Thai Brand Owners

- Diversify Social Media Content: Work with influencers across different levels, from micro-influencers to macro-influencers, to target various age segments.

- Localize Product Formulas: Address diverse Thai skin tones and tap into the demand for natural ingredients, especially post-COVID.

- Omnichannel Strategy: Integrate online and offline experiences—offer in-store product trials or small workshops, while also hosting live-stream sales.

2) South Korea’s Cosmetics Market: The K-Beauty Trendsetter

Key Strengths

- “Fast Beauty”: Korean brands release new product lines frequently—sometimes in under six months—which resonates with consumers eager to try new items.

- Leveraging K-Pop/K-Drama: Celebrities and idols serve as highly influential brand ambassadors, creating a ripple effect both domestically and globally.

- Digital Savvy: Viral content on Instagram and TikTok is a norm, and personalization technologies—like apps for skin analysis—are widely adopted.

Key Challenges

- Mature Domestic Market: The sheer number of local brands leads to intense competition.

- Rapidly Changing Trends: Some products gain quick fame but fade just as fast, making long-term customer loyalty difficult.

- Export Dependence: Crises like COVID significantly reduce tourism and may harm sales.

Strategic Tips for Thai Brand Owners

- Learn from “K-Pop Marketing”: Collaborations with local youth icons or Thai celebrities mirroring K-Pop success can spark excitement among consumers.

- Focus on Novelty: Introduce innovative formulas or distinctive packaging to captivate potential customers—“try it once, you’ll be hooked.”

- Position as “Value-Added”: Even if Thailand’s market may be smaller, creating a brand image of “agile product development” to match trending demands can win over Thai consumers who follow K-Beauty fervently.

3) Japan’s Cosmetics Market: Premium Quality and Trusted Reputation

Key Strengths

- “Less is More”: Japan’s beauty approach favors fewer but higher-quality products with refined textures and meticulous attention to detail.

- Advanced Tech + Traditional Know-How: Traditional ingredients like rice, green tea, or sake fermentation are blended with modern R&D (e.g., AI-based skin analysis).

- Luxurious yet Minimalist Image: Iconic Japanese brands like Shiseido and SK-II project a heritage of precision and quality, which consumers deeply trust.

Key Challenges

- Relatively Modest Digital Marketing: Compared to South Korea, Japan leans less on aggressive advertising, and consumers remain accustomed to in-store product trials.

- Aging Society: Marketers must engage a younger demographic that increasingly turns to K-Beauty.

- Perception of Being “Too Quiet”: Japan’s market may appear static compared to the swift changes in Korea or the U.S.

Strategic Tips for Thai Brand Owners

- Highlight “Quality and Simplicity”: Reinforce premium craftsmanship and top-tier production standards if your brand focuses on carefully selected ingredients.

- Adopt a Japanese-Style Storytelling: Narrate your brand’s origin or mission to build long-term emotional connections with customers.

- Embrace AR/AI Technology: Enable virtual skin scans and personalized shade-matching to offer a fresh, modern experience in the Thai market.

4) The U.S. Cosmetics Market: Cutting-Edge Marketing and Tough Competition

Key Strengths

- Large, Diverse Market: U.S. cosmetics sales rank among the world’s highest. The market spans mass, prestige, and indie segments.

- Influencer/Celebrity Power: The rise of celeb-driven brands (Fenty Beauty, Kylie Cosmetics, Rare Beauty) showcases how quickly new labels can achieve success.

- Multifaceted Marketing Strategies: From grand-scale events to indie-level online communities like Glossier, innovation abounds.

Key Challenges

- High Competition & Rapid “Switching”: Trends come and go quickly; brand loyalty is often low.

- Costly Marketing: Influencer fees and advertising budgets are typically higher than in many other countries.

- Demand for Social Responsibility: Brands must be transparent, inclusive, and sustainable to satisfy consumer expectations.

Strategic Tips for Thai Brand Owners

- Carve a Specific Niche: Use a clear differentiator (e.g., “Thai herbal ingredients” or “Clean Beauty”) that aligns with global trends.

- Inclusive Storytelling: Consider expanding foundation ranges to cover diverse skin tones—beyond just fair to medium—mirroring the inclusivity movement in the U.S.

- Experiment with Collaborations: Partner with local or international influencers, or even co-brand with another label, to launch special collections.

Consumer Personas in 4 Countries: Animal Characters

Thailand = “Bee – The Social & Collaborative”

Thai consumers behave much like bees, living within a buzzing hive that constantly exchanges information. Social media is their lifeblood, where they share reviews and product news at lightning speed.

South Korea = “Dolphin – The Trend Surfer”

Korean consumers are agile, surfing waves of new trends confidently—driven by K-Pop and K-Drama influences—mirroring dolphins that effortlessly navigate waves.

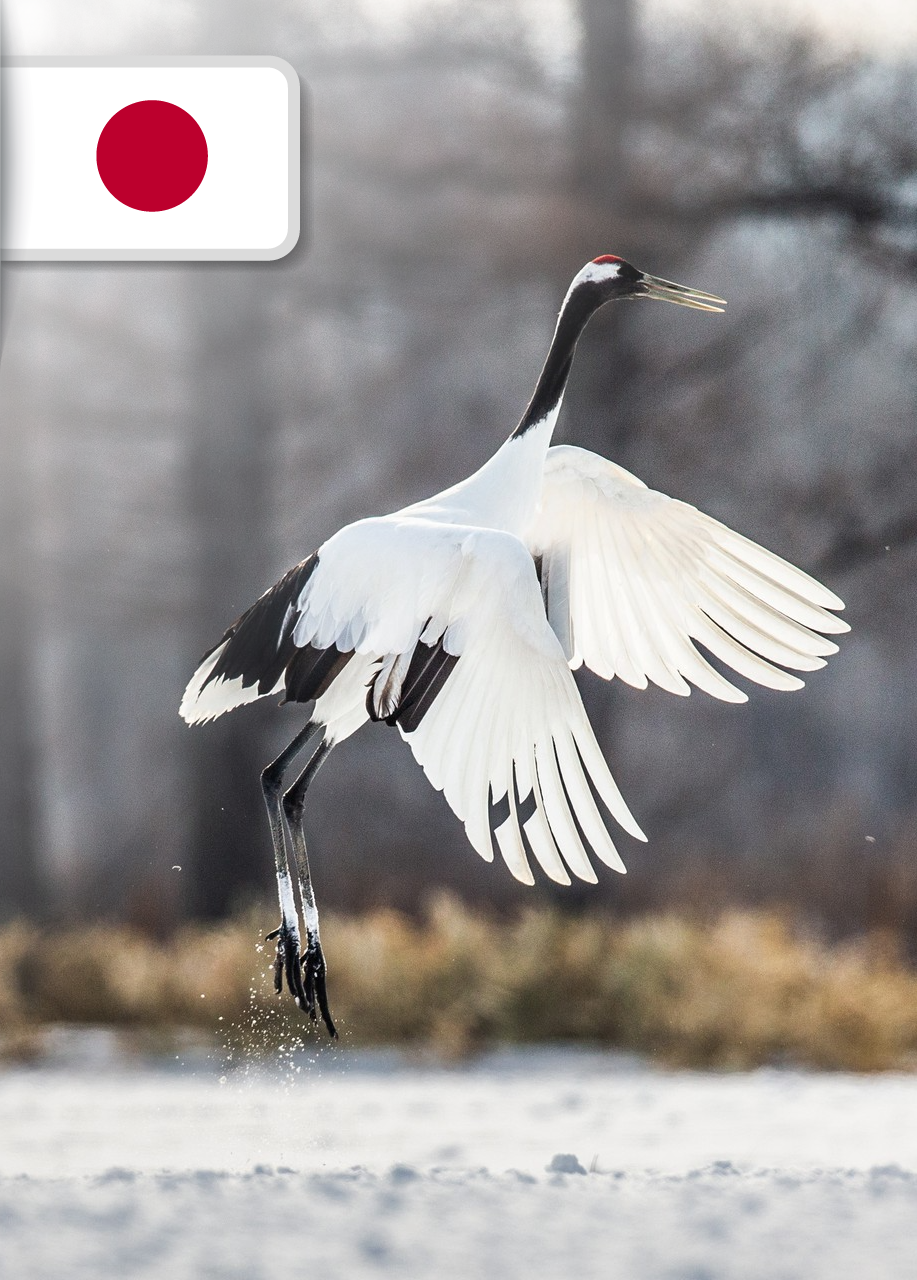

Japan = “Crane – The Zen Perfectionist”

Japanese consumers favor a serene, minimalist approach, prioritizing high-quality products and brand loyalty that lasts. This quiet precision recalls the elegance of the crane.

USA = “Eagle – The Bold Explorer”

Americans, like eagles, roam freely in search of new frontiers. They enjoy experimenting with fresh brands and do not hesitate to switch if they find something better.

How to Adapt Foreign Strategies for Thai Brands

Hybrid Strategy

- Study K-Beauty for rapid product development and wave-riding marketing.

- Learn from J-Beauty for a refined, premium brand image.

- Incorporate American-style celebrity marketing, but keep budgets appropriate for the Thai market.

Deep Localization

- Investigate Thai consumer insights, focusing on “value for money” and the trust-building power of genuine reviews.

- Tailor product formulations to suit the hot, humid climate and a variety of local skin tones.

Storytelling & CSR

- Develop brand narratives that highlight local identities: safe use of Thai herbs, eco-conscious practices, or farmer support initiatives.

- Emphasize “diversity and sustainability,” following the example of Fenty and other socially responsible American brands.

Collaboration & Ambassador

- Team up with KOLs or artists from neighboring countries (e.g., Laos, Vietnam, Cambodia) to expand regional market reach.

- Consider inviting a K-pop idol or Japanese influencer to join an online campaign, leveraging popular local social media platforms.

Summary and Strategic Takeaways

The modern cosmetics market transcends borders. Thailand, South Korea, Japan, and the U.S. each employ diverse marketing methods to capture distinct consumer behaviors. Success relies not on copying one market’s approach outright, but on “selecting and adapting key strengths” to fit each brand’s context. Learning from K-Beauty can teach Thai brands the art of rapid launches and harnessing pop-culture influences. Studying J-Beauty highlights the value of minimalism and precision. Meanwhile, the U.S. market demonstrates the power of influencers and inclusive storytelling.

Thai brands aspiring to scale and enter global competition should plan product development with agility, coupled with content- and community-driven marketing to foster loyalty. Additionally, build strong storytelling that showcases a unique Thai heritage or brand specialty, ensuring long-term success on the international stage.

References

- [Beauty care in Thailand – An attractive market – Issuu](https://issuu.com/germanthaichamber/docs/update_q4-2023_beauty_and_cosmetics/s/38897960)

- [How does Thai beauty brand Mistine become so popular on TikTok? – Shoplus](https://www.shoplus.net/blogs/Mistine-case-study)

- [Thailand’s health and beauty market booms, fuelled by competition – NationThailand](https://www.nationthailand.com/business/corporate/40044413)

- [How K-Beauty Brands Are Dominating Digital Marketing: A Deep Dive into Strategies and Successes – everything-pr.com](https://everything-pr.com/how-k-beauty-brands-are-dominating-digital-marketing-a-deep-dive-into-strategies-and-successes)

- [Marketing lessons from the South Korean beauty industry – PR Daily](https://www.prdaily.com/marketing-lessons-from-the-south-korean-beauty-industry)

- [The Japanese Beauty Industry: Trends and Statistics in 2024 and Beyond – ShikoBeauty](https://shikobeauty.com/pages/japanese-beauty-industry-statistics)

- [Beauty trends: All about J-beauty – Covalo Blog](https://blog.covalo.com/personal-care/japanese-beauty-trends)

- [Case Study: How Shiseido increased its influencer marketing success by 54% – Cosmetics Business](https://cosmeticsbusiness.com/case-study-how-shiseido-increased-its-influencer-marketing-success-by-54–203633)

- [Social Media and the Beauty Industry: 2024 Guide – Sprinklr](https://www.sprinklr.com/blog/social-media-for-beauty-industry)

- [Which beauty brands and influencers won on social media in 2024? – Vogue Business](https://www.voguebusiness.com/story/beauty/which-beauty-brands-and-influencers-won-on-social-media-in-2024)

- [Estee Lauder Marketing Strategy 2025: A Case Study – Latterly.org](https://www.latterly.org/estee-lauder-marketing-strategy)

- [How Laneige became a ‘significant player’ in skin care in 2024 – Glossy](https://www.glossy.co/beauty/how-laneige-became-a-significant-player-in-skin-care-in-2024)

- [Laneige revs up global growth for Amorepacific – Retail Beauty](https://retailbeauty.com.au/laneige-revs-up-global-growth-for-amorepacific)